The Community Foundation of Broward, the Jewish Federation of Broward County and United Way Broward joined forces 24 years ago to hold a Joint Tax & Estate Seminar for professional advisors in Broward County. This year’s seminar builds on a tradition of delivering cutting-edge presentations by nationally renowned speakers, superior educational experiences, and prime networking opportunities.

Sponsorship opportunities are available, and ticket sales are now open. Do not miss this opportunity to attend South Florida’s premier tax and estate planning event!

Register for Event

Join us this year for the 23rd Annual Joint Tax and Estate Planning Seminar.

Become a sponsor:

The 2025 sponsorship opportunities offer even greater benefits than previous years, amplifying your company’s exposure to like-minded business professionals and industry leaders.

Who will attend

- Attorneys

- Certified Public Accountants

- Investment Consultants

- Financial Advisors / Wealth Managers

- Insurance Agents

- Certified Financial Planner™ Professionals

Individual tickets available:

Not attending as a sponsor or with a group? No problem! Individual tickets are available which grants registrants entry to the entire seminar, including the networking reception and keynote presentation. The Early Bird ticket price is $75 per person and is available before September 15, 2025. After September 15, 2025 the price will be $100.00 per person.

For more information, questions or assistance in registering please email [email protected].

Featured Speaker

Mark R. Parthemer, JD, AEP®, ACTEC Fellow

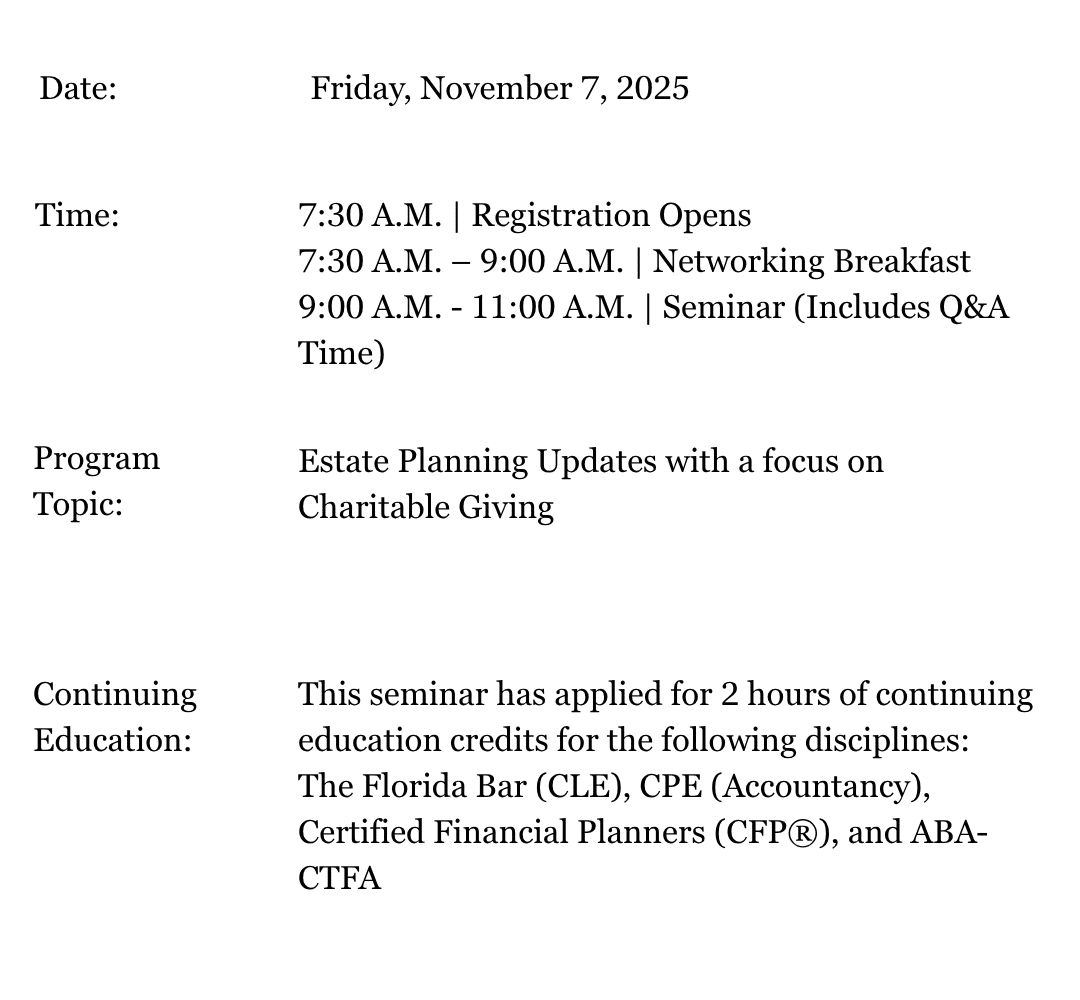

Topic: Estate Planning Updates with a focus on Charitable Giving

Mark R. Parthemer, JD, AEP®, ACTEC Fellow, is Glenmede’s Chief Wealth Strategist and Florida Regional Director. He is responsible for developing and communicating Glenmede’s position and strategy concerning tax, estate planning and fiduciary matters pertinent to clients and their advisors, as well as cultivating the growth and operations of Glenmede throughout Florida.

Prior to joining Glenmede, Mr. Parthemer served as Managing Director for TIAA and Managing Director and Senior Fiduciary Counsel for Bessemer Trust, working with ultra-high-net-worth clients to deliver sophisticated tax and estate planning advice and provide tailored guidance. His previous roles include partner at Duane Morris, LLP, and Senior Tax professional at PricewaterhouseCoopers.

Mr. Parthemer is a Fellow of the American College of Trusts Estates Counsel, and President of Florida Bankers Association Trust and Wealth Management Division. He is also Group Vice Chair for the American Bar Association, RPTE Trusts and Estate Practice Group and often faculty for the University of Miami’s prestigious Heckerling Institute. He earned a Bachelor of Arts and a Bachelor of Science from Franklin & Marshall College and Juris Doctor from The Dickinson School of Law, Penn State University.

Mr. Parthemer is a nationally recognized speaker and a frequently published author. He is an editor and columnist for the Journal of Financial Services Professionals and for the ABA’s Probate & Property magazine. He is often quoted on tax and estate planning matters in publications such as the Wall Street Journal, Barron’s, Bloomberg Tax and Kiplinger’s.

MODERATOR:

Tom Hudson

Senior Economics Editor and Special

Correspondent | WLRN | PBS & NPR

Presenting Organizations

Community Foundation of Broward

Jewish Federation of Broward County

United Way Broward

Founded in 1984, the Community Foundation of Broward partners with families, individuals and organizations to create personalized charitable funds that deliver game-changing philanthropic impact. The Community Foundation transforms our community through focused leadership that fosters collaboration, builds endowment, advances equity and connects people who care to causes that matter. The Foundation empowers visionaries, innovators and doers to create the change they want to see in the community – and to BE BOLD.

510 charitable Funds

$235 million in assets

$158 million in grants

38 years of philanthropic impact

Through the generosity of so many who had the vision to ‘create a Jewish legacy,’ the Jewish Federation of Broward County’s Jewish Community Foundation’s $180 million endowment fund ensures that Jewish values are secured in perpetuity. By promoting smart philanthropic strategies, the Jewish Community Foundation is dedicated to optimizing your investment returns and maximizing your financial growth potential, helping to provide maximum impact on life-sustaining programs such as feeding the hungry, helping those in need, protecting abused children and domestic violence victims, promoting impactful Jewish identity programs, supporting the elderly and individuals with special needs, fighting antisemitism, and strengthening the bonds with Israel and the global community at large.

For more than 85 years, United Way Broward has connected partners across public, private, and social sectors to co-create solutions to people’s most pressing challenges.

From strengthening local resilience to advancing health, youth opportunity, and financial security, we’re working toward a future where every person in our community can reach his or her full potential.

United Way Broward is a force for good, mobilizing the power of compassion to create change and uplift lives. True to our founding spirit, wherever there is a need, United Way Broward is there — listening, responding, and developing tangible solutions. By embracing innovation and working with a wide range of community partners, we are expanding our impact and ensuring a brighter future so everyone can rise and thrive.

Steering Committee

2025 Co-Chairs:

John W. Clidas, CPA/PFS, CFP®, ChFC®, AEP®, CEPA®, RICP® Synovus Trust Company, N.A

Representing: Community Foundation of Broward

Scott Bakal, Esq.

Greenberg Traurig, P.A.

Representing: Jewish Community Foundation of Broward

Sean M. Riley CPWA®, CFP®

UBS Private Wealth Management

Representing: United Way Broward

Alan B. Cohn Esq.

Greenspoon Marder

Isaac Coifman

Berkowitz Pollack Brant Advisors + CPAs

Marco Crespi

PNC Private Bank

Richard DeNapoli

Coral Gables Trust

Sheri Fiske Schultz CPA, ABV, CFF

Fiske & Company

Trevor Fried

The Las Olas Group at Morgan Stanley

Randy S. Friedlander CIMA®, CPWA®

The Friedlander Group, Morgan Stanley

Barry Gurland

Daszkal Bolton

Philip Herzberg, CFP, CTFA, AEP, MSF

Team Hewins

Denise A. Lettau Esq.

National Care Advisors

Gloria Lozada-Adams

Bank of America Private Bank

Lance Lvovsky, CPA

Marcum LLP

Linda Paige

Synovus Trust Company

Arlene Ravalo Jao CPA, CFF, ABV

Cherry Bekaert Advisory, LLC

Mark Wisniewski Esq.

Berger Singerman

Charles Verner

UBS Financial Services

Kurt D. Zimmerman Esq.

Zimmerman & Associates

Presenting Organizations:

Community Foundation of Broward: Mary Margaret Toole

Jewish Federation of Broward County: Keith M Goldmann, Judy Levenson

United Way Broward: Patrick Harris

History

2023

Tanya Bower, Esq., Tripp Scott, P.A.

David Appel, CPA, PFS, Marcum, LLP

Sean Riley, CPWA®, CFP®, UBS Private Wealth Management

2022

Tanya Bower, Esq., Tripp Scott, P.A.

David Appel, CPA, PFS, Marcum, LLP

Carole Enisman, Premier Wealth Planning

2021

Kaley N. Barbera, J.D., LL.M., Snyder & Snyder, P.A.

Jill R. Ginsberg, J.D., B.C.S., Ginsberg Shulman

Stephanie Aoun, Goldman Sachs

2020

Kaley N. Barbera, J.D., LL.M., Snyder & Snyder, P.A.

Jill R. Ginsberg, J.D., B.C.S., Ginsberg Shulman

Stephanie Aoun, Goldman Sachs

2019

Program – Planning for an Aging Population Update – Preparing for the Unexpected: Designing and Drafting Estate Plans that Can Withstand the Heat!

Marc Infante, RICP, Wells Fargo Advisors

Marc Lowell CLU, ChFC, The A.I.D. Group

Greg Medalie, Esq., Medalie & Medalie, P.A.

2018

Program – Working “9-5”, but Hopefully Not Forever – 201 Best & Worst Retirement Ideas.

Luncheon – IRA Mistakes and How to Fix Them

Judy B. Bonevac, Esq., Judy Barringer Bonevac, P.A.

Adam Scott Goldberg, Esq., Krause, Goldberg, Revis & Hervas, P.A.

Sean M. Riley, CPWA®, CFP®, UBS Private Wealth Management

2017

Pressing the Do-Over Button: Strategies for Modifying Wills & Trusts After Formation

Joseph Eppy, The Eppy Group

Denise A. Lettau, Wells Fargo Private Bank

William A. Snyder, J.D., LL.M., Snyder & Snyder, P.A.

2016

Cover Your Assets – A Simple and Ethical Approach to Asset Protection

Don Medalie, Esq., Community Foundation of Broward

Randy Friedlander, CIMA®, CPWA®, Jewish Community Foundation of Broward

Joseph Eppy, United Way of Broward County

2015

Modern Family Dilemmas: Retirement Planning for Today and Tomorrow

Gary L. Rudolf Esq., Community Foundation of Broward

Jeffrey Saster, Jewish Community Foundation of Broward

Michael D. Wild Esq., United Way of Broward County

2014

Income Tax Planning for Estate Planners: Doing Well by Doing Good – A Winning Combination

James B. Davis, Esq., Community Foundation of Broward

Mark Krill, Jewish Community Foundation

Penelope Blair, United Way

2013

Planning for an Aging Population – Your Clients, Your Parents and Someday You!

A Straight Talk on the Legal, Financial and Family Dynamics

Christy Lambertus, Esq., Community Foundation of Broward

Alan B. Cohn, Esq., Jewish Community Foundation

Peter Anderson, United Way

2012

Estate Planning Strategies in a Post-Election World

Kurt D. Zimmerman, Esq. , Community Foundation of Broward

Terry L. Breitbord, CLU, ChFC, MSFS, Jewish Community Foundation

Scott Rassler, JD., CLU, ChFC, United Way

2011

Connecting the Dots-Creating Some POP (Partnership of Professionals)

And Sizzle for Your Clients’ Planning Needs

Kenneth B. Bierman, United Way

Frank B. Brogan, Jr., Esq., Community Foundation

Sheldon S. Polish, Esq., Jewish Community Foundation

2010

How Clear Was Your Crystal Ball? A Review of Last Year’s Significant Events in the Chaotic World of Estate Planning

Frank T. Adams, Esq., Community Foundation

Jay R. Beskin, Esq., United Way

Jason L. Steinman, Esq., Jewish Community Foundation

2009

Mirror, Mirror on the Wall, If I get too Creative, Will the Tax Man Call?

Jay Beskin, Esq., United Way

Jennifer J. Robinson, Esq., Community Foundation

Elissa Mogilesfsky, Jewish Community Foundation

2008

Power Marketing your Estate Planning Practice: An Advanced Seminar for Tax Professionals

Lanny K. Marks, CPA, CFP, United Way

Paul B. McCawley, Community Foundation

Mark Scott, Jewish Community Foundation

2007

Times of Compliance and Complexity: Estate Planning Hotspots

Sheri Schultz, Jewish Community Foundation

Howard Usher, United Way

Alan Cohn, Jewish Community Foundation

2006

My Favorite Wealth Transfer Planning Ideas

Thomas O. Katz, Community Foundation of Broward

Jack Rosenberg, CPA, Jewish Community Foundation

Shawn Snyder, United Way of Broward County Inc.

2005

Postmortem Repair of Charitable Dispositions and Recent Developments… with a Charitable Twist

Myron Sandler, Jewish Community Foundation

Kenneth Bierman, United Way

Barbara Doll, Community Foundation

2004

Importance of Trusts in Estate & Financial Planning

2003

Understanding the New Minimum Distribution Rules

Kenneth Bierman, United Way

Mark Maller, Jewish Community Foundation

William Sullivan, Community Foundation

2002

Current Developments in Estate and Gift Law

Kenneth Bierman, United Way

Francis B. Brogan, Community Foundation

Irwin Weiser, Jewish Community Foundation