EMPOWERING PEOPLE TO

earn, keep and grow assets

We have seen the studies: 37% of all households in Broward County are one emergency away from falling into poverty. Each month is a juggling act for so many, the ALICE (Asset Limited Income Constrained and Employed) population are our neighbors and friends who are facing obstacles beyond their control, frustrating their ability to become financially stable. (Watch the video here.) Through United Way, you are ensuring individuals and families have the skills and tools needed to earn, keep, and grow their assets. Your generosity provides the building blocks for creating a better life.

VITA PROGRAM/BROWARD TAX PRO

VITA is a free tax-preparation and educational service provided for individuals and families with an annual household income of less than $75,000. To learn more, visit vitataxesfree.org.

United Way partners with Broward Tax Pro to provide free tax-preparation services to individuals and families with an annual household income of $75,000 or less. By working together, United Way and Broward Tax Pro offers helpful, cost-free support to individuals who might struggle to navigate the complexities related to tax filing.

These tax services are available in multiple languages, including English, Spanish, Haitian Creole, Portuguese, as well as multiple locations with flexible hours. Broward Tax Pro also offers American sign-language interpreter services at the Center for Independent Living of Broward by appointment only.

Since 2003, the VITA program in Broward County has had a significant financial impact on our community, particularly people in ALICE (Asset Limited, Income Constrained, Employed) households.

Click here for more information and a list of VITA sites.

LIVE A FINANCIAL SECURE LIFESTYLE THROUGH

CONSOLIDATED CREDIT'S FINANCIAL EDUCATION CENTER

SERVICES OFFERED

Free Financial Wellness

Free Financial Counseling

Debt Management Program

FINANCIAL PROSPERITY IMPACT

supported by United Way programs

93%

of respondents increased their level of self-sufficiency through accessing adult education

94%

of respondents were able to increase their level of income self sufficiency

100%

of domestic violence victims were able to remain safe

Featured

SUCCESS STORY

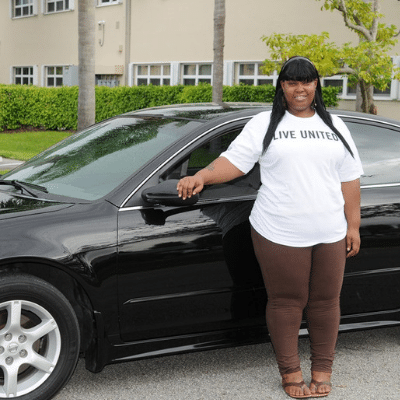

Life as a single mother of three children under the age of 10 can be difficult enough, but lack of transportation proved to be the biggest obstacle for Calandra.